YouTube Deep Summary

YouTube Deep Summary

Extract content that makes a tangible impact on your life

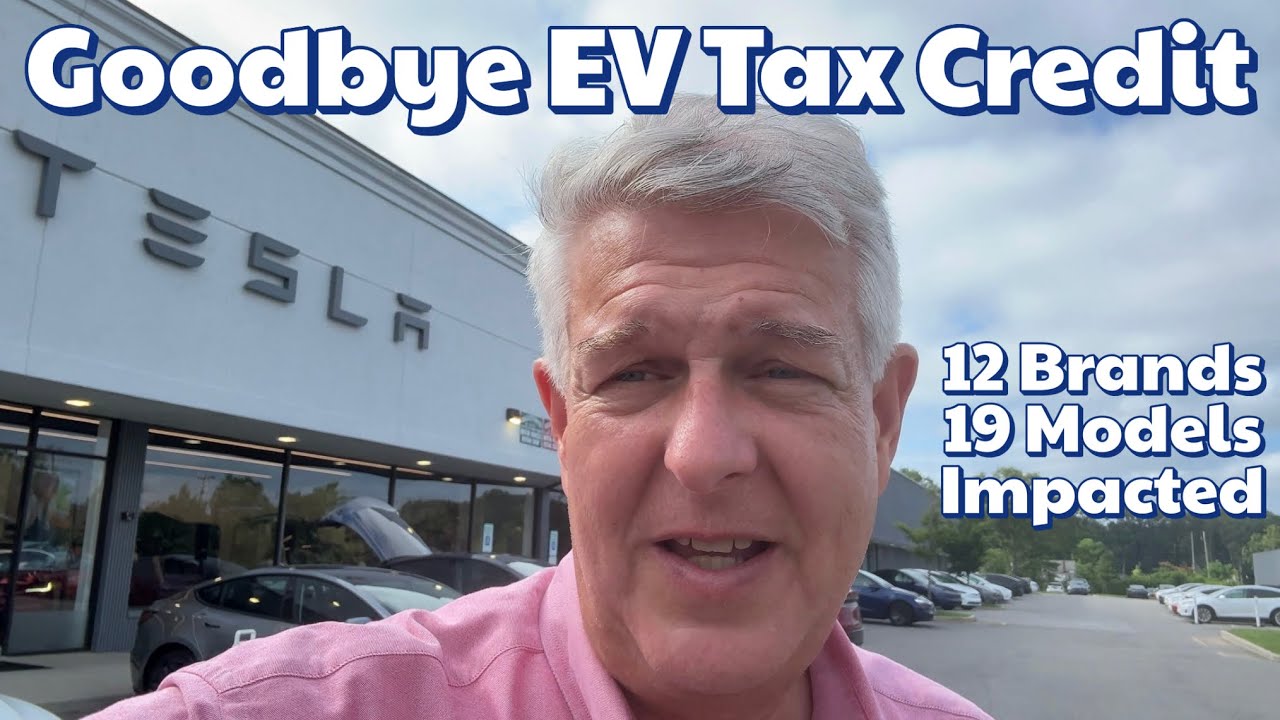

EV Tax Credit Elimination Countdown: Market Pulse & Action Plan

Out of Spec Dave • 2025-07-13 • 33:04 minutes • YouTube

📝 No Transcript Available

Click the "Extract Transcript" button above to download the transcript for this video.