[00:03] (3.27s)

starts right now.

[00:25] (25.23s)

>> Hey I'm Cramer welcome to Mad

[00:27] (27.36s)

Money. Welcome to Cramer. I'll

[00:29] (29.50s)

do my friends I'm just trying to

[00:30] (30.83s)

make a little money. My job not

[00:32] (32.83s)

just to entertain but to

[00:33] (33.90s)

educate. Teach it. Call me one

[00:36] (36.10s)

873 CNBC's Jim Cramer. Maybe you

[00:38] (38.80s)

hate Jay Powell. Maybe you love

[00:40] (40.77s)

him. Maybe you have no idea who

[00:42] (42.48s)

he is, regardless of what you

[00:44] (44.01s)

need to know is that he's in

[00:46] (46.48s)

charge of the Federal Reserve,

[00:47] (47.55s)

so he controls what's known as

[00:48] (48.81s)

short rates. That means the

[00:49] (49.82s)

short term interest rates there

[00:52] (52.38s)

are like the ones you borrowed

[00:55] (55.05s)

today and pay you back tomorrow.

[00:55] (55.72s)

The president appoints the head

[00:56] (56.66s)

of the Federal Reserve. And in

[00:58] (58.49s)

this case, it was President

[00:59] (59.76s)

Trump who hired Powell during

[01:00] (60.99s)

his first term. Trump now thinks

[01:01] (61.86s)

Powell is doing a terrible job

[01:03] (63.53s)

because he won't cut interest

[01:05] (65.93s)

rates. So the president takes

[01:07] (67.10s)

jabs at him every chance he

[01:08] (68.50s)

gets. Unfortunately, this

[01:10] (70.70s)

presidential obsession has a lot

[01:12] (72.64s)

of impact on the markets today,

[01:14] (74.07s)

for example, we got hit on

[01:15] (75.21s)

rumors that Trump will fire

[01:16] (76.48s)

Powell, and then the market came

[01:18] (78.14s)

back when the president said

[01:19] (79.88s)

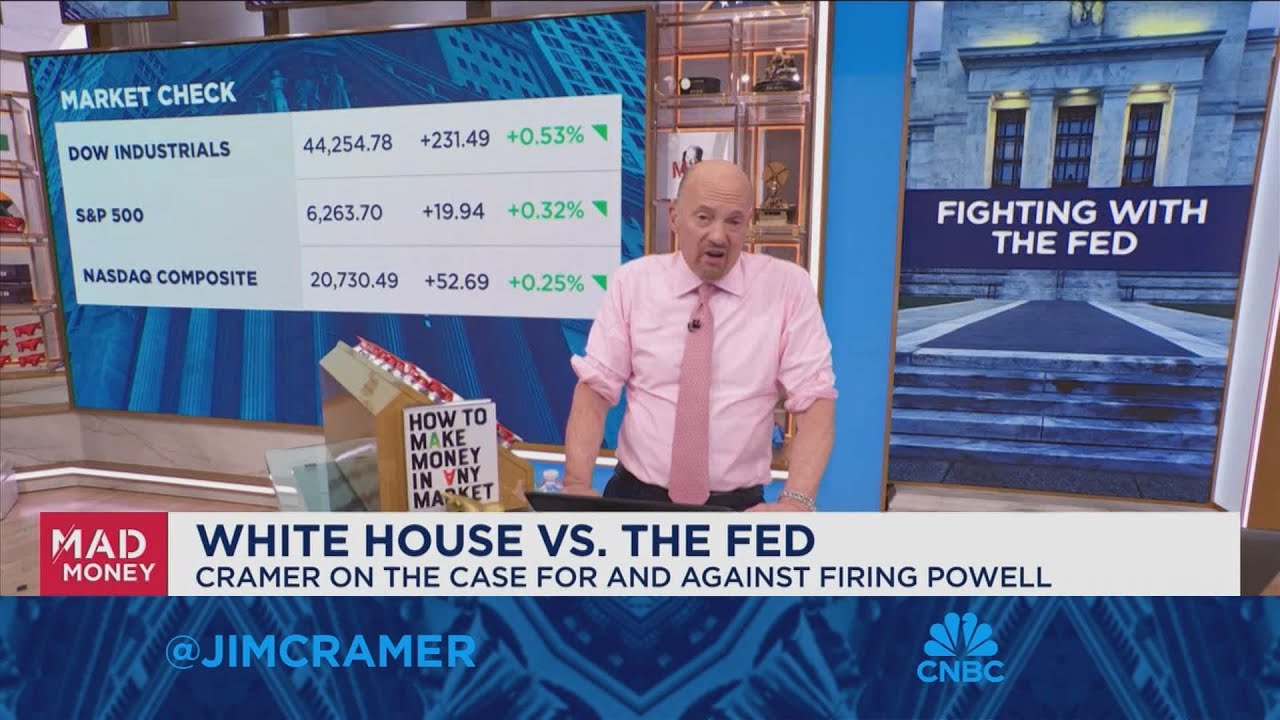

it's not true. Dow only gaining

[01:21] (81.51s)

231 points, has to be advancing

[01:22] (82.88s)

0.32%, Nasdaq climbing 0.2 5%.

[01:24] (84.72s)

Now, I thought the sell off on

[01:26] (86.09s)

the rumor and the sharp rally on

[01:27] (87.95s)

the news of the president

[01:29] (89.32s)

letting Powell alone was

[01:32] (92.26s)

dispositive. And I'm going to

[01:33] (93.39s)

tell you why the president wants

[01:36] (96.16s)

Powell out. But when we got a

[01:37] (98.00s)

whiff of the rumor that he'd

[01:39] (99.06s)

take action longer term,

[01:41] (101.07s)

interest rates went up with the

[01:42] (102.97s)

sacred 30 year Treasury going

[01:45] (105.17s)

from 4.97% to 5.07. Now, that's

[01:48] (108.01s)

done in an hour. I know it's

[01:49] (109.54s)

small, but you know the

[01:50] (110.51s)

direction. The direction is for

[01:52] (112.05s)

interest rates to go higher.

[01:52] (112.98s)

Bad. At the same time, the S&P

[01:55] (115.42s)

500 went from 6254 to 6201 on

[01:59] (119.39s)

the rumor, but then rallied back

[02:01] (121.15s)

to six two, six three after the

[02:02] (122.99s)

denial. Good. So clearly the

[02:06] (126.13s)

stock and bond markets don't

[02:07] (127.53s)

want Powell getting ousted.

[02:08] (128.79s)

Isn't that that's not right

[02:09] (129.66s)

there. Boom. Now is Powell. The

[02:11] (131.46s)

issue here is that the Wall

[02:12] (132.76s)

Street's terrified of the idea

[02:15] (135.10s)

that the president might be able

[02:17] (137.17s)

to fire the fed chief, something

[02:18] (138.74s)

he's not supposed to be able to

[02:20] (140.84s)

do legally. He doesn't have the

[02:21] (141.61s)

authority. But the Republicans

[02:23] (143.34s)

control all three branches of

[02:23] (143.98s)

government right now. Trump's

[02:24] (144.91s)

the guy. Of course, there are

[02:27] (147.05s)

still institutions that are

[02:28] (148.15s)

concerned about Federal Reserve

[02:28] (148.85s)

independence, but they're

[02:29] (149.48s)

financial institutions, not

[02:30] (150.58s)

political ones. The financial

[02:32] (152.35s)

institutions don't have as many

[02:34] (154.15s)

divisions as the political ones,

[02:34] (154.92s)

and they never will. What is

[02:37] (157.39s)

rarely talked about is why

[02:38] (158.59s)

Powell even bothers to stay.

[02:40] (160.06s)

What's the point of taking this

[02:41] (161.66s)

now? As someone who's had his

[02:42] (162.79s)

share of national ridicule, it's

[02:44] (164.76s)

not something you look forward

[02:45] (165.47s)

to. But when you look at the

[02:47] (167.50s)

action in the stock and bond

[02:49] (169.74s)

markets today, how we went down

[02:50] (170.50s)

when the rumor was first

[02:51] (171.67s)

floated, went up when the

[02:53] (173.57s)

president walked it back. It's

[02:54] (174.81s)

worth asking why stocks didn't

[02:55] (175.71s)

soar when we thought Powell was

[02:57] (177.58s)

getting fired. Soar. Stocks are

[02:58] (178.71s)

supposed to benefit from lower

[03:00] (180.58s)

interest rates, right? You cut

[03:02] (182.28s)

rates, you get better business

[03:03] (183.55s)

formation. You get stronger

[03:04] (184.35s)

employment. Housing market gets

[03:05] (185.88s)

stimulated by teaser rates. So

[03:07] (187.02s)

why didn't stocks blast off?

[03:08] (188.56s)

When we heard Powell, who is

[03:10] (190.52s)

standing in the way of all that

[03:12] (192.66s)

was was sacked, why didn't why

[03:14] (194.96s)

did the market go up? Good

[03:16] (196.76s)

question. One that I think the

[03:17] (197.70s)

president has to be pondering.

[03:19] (199.73s)

But therein lies the problem.

[03:21] (201.07s)

The market, at least today, is

[03:22] (202.13s)

saying that Trump might be very

[03:23] (203.87s)

wrong about firing Powell.

[03:26] (206.21s)

What's the case for firing this

[03:27] (207.64s)

man? We spoke to presidential

[03:28] (208.91s)

adviser Peter Navarro last week,

[03:30] (210.34s)

and he thinks a good reason to

[03:31] (211.71s)

fire him is that he's got a

[03:33] (213.91s)

terrible track record. According

[03:34] (214.71s)

to Navarro, 2018 Powell took

[03:36] (216.45s)

rates up in the face of

[03:37] (217.72s)

incipient weakness. 2021 he

[03:39] (219.45s)

didn't take rates up because he

[03:40] (220.49s)

thought that inflation was

[03:41] (221.69s)

transitory. I'll admit that

[03:42] (222.75s)

Powell is not perfect. Nobody

[03:44] (224.09s)

bats 1000. But we have to ask,

[03:45] (225.86s)

should we judge him harshly for

[03:47] (227.16s)

holding rates steady right now?

[03:48] (229.00s)

Or to put it another way, why

[03:50] (230.16s)

hasn't Powell started cutting

[03:51] (231.46s)

rates again? We had a cooler

[03:53] (233.47s)

than expected PPI number today

[03:54] (234.53s)

that could make it easier to

[03:56] (236.50s)

justify a rate cut, right. But

[04:00] (240.34s)

how about inflation? The

[04:03] (243.08s)

incredibly important consumer

[04:04] (244.11s)

price index from yesterday had

[04:05] (245.54s)

some prices that had some signs

[04:07] (247.28s)

of inflation from the

[04:08] (248.55s)

president's tariffs, higher

[04:09] (249.68s)

prices for clothing, furniture,

[04:11] (251.02s)

cleaning products, food away

[04:12] (252.15s)

from home, meats, poultry,

[04:13] (253.95s)

coffee, gasoline, even soft

[04:15] (255.75s)

drinks. That's a long list. Now

[04:17] (257.62s)

is the tracing right? Appliances

[04:19] (259.29s)

and canned fruits and vegetables

[04:20] (260.49s)

went up because of tariffs for

[04:21] (261.79s)

certain. We know that from

[04:23] (263.80s)

ConAgra that the price of tin

[04:25] (265.73s)

cans went higher. Tariffs on

[04:26] (266.33s)

aluminum cans, including soda

[04:26] (266.93s)

cans, more expensive Korean and

[04:28] (268.27s)

Chinese appliances, went up in

[04:29] (269.84s)

price because of that steel

[04:30] (270.94s)

tariff. That helps give

[04:32] (272.40s)

whirlpool an edge, but it hurts

[04:33] (273.77s)

you because you have to pay more

[04:35] (275.64s)

coffee imported. So the fall of

[04:37] (277.48s)

the tariffs meat and poultry.

[04:39] (279.25s)

That's more problems with do the

[04:40] (280.78s)

herds and flocks furniture to

[04:42] (282.05s)

move out of China raise prices.

[04:43] (283.48s)

Same thing with clothing.

[04:44] (284.62s)

Tariffs are the issue against

[04:46] (286.02s)

all this though if you know

[04:47] (287.65s)

where to shop. Not something

[04:48] (288.95s)

that they put in these numbers.

[04:50] (290.96s)

Amazon Walmart Costco the prices

[04:52] (292.82s)

are tame. Come on score one for

[04:55] (295.16s)

the president. However, we don't

[04:57] (297.13s)

know how high the tariffs are

[04:59] (299.67s)

going to go and he seems to roll

[05:00] (300.63s)

out new ones every day. We don't

[05:02] (302.54s)

know if there's going to be

[05:04] (304.30s)

doubling or tripling in some

[05:05] (305.37s)

countries. We haven't seen the

[05:06] (306.51s)

car and truck tariffs that we

[05:08] (308.01s)

all fear. We haven't seen how

[05:09] (309.44s)

much the important parts of a

[05:10] (310.51s)

house drove up the price of

[05:12] (312.55s)

homes. We're nowhere near

[05:14] (314.51s)

finishing tariffs. And that's

[05:15] (315.15s)

what Powell wants to wait for.

[05:16] (316.62s)

That's why that's why he's on

[05:17] (317.92s)

hold. He's prudent. Score one

[05:20] (320.19s)

for Powell. So what's the case

[05:21] (321.62s)

against Powell's patience. If

[05:23] (323.06s)

you believe the economy is about

[05:24] (324.56s)

to fall apart then there's no

[05:26] (326.29s)

time to wait. But we just heard

[05:28] (328.29s)

from the big banks over the last

[05:29] (329.53s)

two days. Not one of them said

[05:31] (331.80s)

the consumer is hurt a lot of

[05:32] (332.50s)

that's because it's still

[05:33] (333.67s)

incredibly easy to find a job.

[05:35] (335.67s)

Sure, there are lots of layoffs

[05:37] (337.40s)

at the banks themselves, but

[05:38] (338.30s)

there aren't a lot of white

[05:39] (339.87s)

collar workers without jobs. I

[05:40] (340.77s)

find it very hard to worry about

[05:42] (342.71s)

a downturn when unemployment is

[05:44] (344.34s)

at 4.1%. That's the problem with

[05:45] (345.68s)

President Trump's position. The

[05:46] (346.61s)

Fed's supposed to cut in a

[05:48] (348.31s)

slowdown, but we don't have a

[05:49] (349.35s)

slowdown. And the only thing

[05:50] (350.82s)

that might cause one is the

[05:52] (352.32s)

president's tariff policy. It's

[05:53] (353.85s)

paradoxical Mexican standoff. If

[05:54] (354.52s)

Powell doesn't wait, if he cuts

[05:55] (355.89s)

front running the August set of

[05:57] (357.32s)

tariffs, he behaving. And if

[05:58] (358.73s)

he's wrong he'll look like a

[05:59] (359.86s)

fool. He has absolutely no

[06:01] (361.03s)

reason to cut other than to stop

[06:03] (363.23s)

the heckling. What's in it for

[06:04] (364.43s)

President Trump if he tries to

[06:06] (366.60s)

fire Powell? I think we saw it

[06:07] (367.87s)

today. Nothing. The stock market

[06:08] (368.77s)

would get rocked. Long term

[06:10] (370.64s)

interest rates would rise. What

[06:11] (371.37s)

president would want that to

[06:12] (372.84s)

happen? If I were President

[06:13] (373.84s)

Trump, I'd wait to see what

[06:15] (375.64s)

happens with his tariffs. As

[06:16] (376.61s)

long as inflation is stable two

[06:18] (378.54s)

and a half months from now, then

[06:19] (379.98s)

by all means bash Powell for

[06:21] (381.68s)

refusing to cut rates. But today

[06:23] (383.42s)

should have been a real wake up

[06:24] (384.55s)

call. For who? For the

[06:25] (385.65s)

president. He doesn't self no

[06:27] (387.72s)

favors if he fires Powell, even

[06:28] (388.62s)

if he thought Powell was a

[06:30] (390.36s)

doofus, which he most decidedly

[06:32] (392.12s)

is not, you would still be

[06:32] (392.89s)

fighting all the usual enemies.

[06:34] (394.19s)

You charge the Fed's

[06:35] (395.39s)

independence. I'm one of them.

[06:36] (396.80s)

It's been good for it's good

[06:38] (398.36s)

good policy for our great

[06:40] (400.13s)

nation. It's worked. Ain't

[06:41] (401.23s)

broke. Don't fix. So, Mr.

[06:43] (403.27s)

President, write down this one.

[06:44] (404.34s)

May 15th, 2026. That's when

[06:45] (405.77s)

Jay's done it. Loyalty is clear

[06:47] (407.91s)

to the country. It can't be

[06:49] (409.41s)

that. Plus this whole rap about

[06:51] (411.01s)

how Powell may have spent too

[06:52] (412.35s)

much money on the Federal

[06:53] (413.75s)

Reserve renovation. Why is he

[06:55] (415.55s)

like that guy? He's like, it's

[06:57] (417.05s)

not his house. Trump's

[06:57] (417.85s)

credibility is hurt by this.

[06:59] (419.22s)

This Powell looked like a guy

[07:00] (420.65s)

who cares about this stuff. Does

[07:02] (422.82s)

he does he look like a

[07:04] (424.32s)

contractor? Honestly, the guy is

[07:05] (425.22s)

so intense about his job that if

[07:06] (426.46s)

you told me he didn't even

[07:08] (428.29s)

choose the color of paint in his

[07:09] (429.73s)

own office, I believe you.

[07:11] (431.60s)

Bottom line, I hope today is the

[07:12] (432.63s)

last day that Trump goes after

[07:14] (434.57s)

Jay Powell, whose term ends in

[07:15] (435.74s)

ten months. Anyway. Got it for

[07:17] (437.60s)

Powell only hurt Trump the same

[07:18] (438.90s)

way it hurts the markets. And I

[07:20] (440.61s)

don't think the president's a

[07:22] (442.57s)

masochist. At the end of the

[07:24] (444.31s)

day, we're either going to see

[07:25] (445.94s)

more inflation or not. If

[07:26] (446.51s)

inflation really does pick up,

[07:27] (447.71s)

firing Powell won't matter

[07:28] (448.78s)

because the rest of the Federal

[07:30] (450.62s)

Market Committee won't let him

[07:31] (451.45s)

cut either. Mr. President,

[07:32] (452.55s)

sometimes this is genius by me.

[07:34] (454.52s)

It's better to leave well enough

[07:36] (456.32s)

alone. Hey, let's go to Tom in

[07:38] (458.02s)

Illinois, please. Tom.

[07:39] (459.83s)

>> Hey, Jim.

[07:40] (460.59s)

>> Thanks for taking my call.

[07:41] (461.99s)

>> My pleasure. What's up?

[07:44] (464.06s)

>> I wonder what you think about

[07:45] (465.73s)

Sony. I know the government's

[07:47] (467.23s)

coming after Japan with tariffs.

[07:48] (468.80s)

How do you think that'll affect

[07:50] (470.04s)

the stock?

[07:50] (470.97s)

>> I don't want to be there. I

[07:52] (472.81s)

won't be there because I think

[07:54] (474.94s)

Japan's going to get the brunt.

[07:56] (476.31s)

Too many soldiers there. We've

[07:57] (477.71s)

done too much for them. I think

[07:59] (479.64s)

that Japan and Korea, the next

[08:00] (480.28s)

wave is what I think that Jay

[08:02] (482.05s)

Powell is worried about, too.

[08:02] (482.92s)

The next wave is going to be

[08:05] (485.69s)

really. It's just going to be.

[08:08] (488.55s)

>> Stop, stop, stop. The house

[08:10] (490.92s)

of pain.

[08:11] (491.16s)

>> Let's go to Rick in Illinois,

[08:12] (492.62s)

please. Rick.

[08:13] (493.99s)

>> Jimmy, how are you today?

[08:15] (495.83s)

>> I'm having a pretty good day.

[08:17] (497.93s)

How about you?

[08:18] (498.30s)

>> It was okay, except for this

[08:20] (500.47s)

Powell announcements during the

[08:22] (502.33s)

day. It's a little bit

[08:23] (503.37s)

upsetting, but we move on. Jim,

[08:25] (505.07s)

I've been an acolyte of years

[08:26] (506.94s)

since since Cramer and Kudlow.

[08:29] (509.91s)

>> No that's not possible

[08:31] (511.14s)

because it was Kudlow and Cramer

[08:32] (512.51s)

I lost a coin flip I wanted

[08:34] (514.18s)

Cramer and Kudlow I mean let's

[08:35] (515.95s)

just tell the truth. After 25

[08:36] (516.85s)

years it's time to tell the

[08:38] (518.62s)

truth I wanted Cramer in Kudlow.

[08:40] (520.89s)

So did my dad. All right what

[08:42] (522.02s)

else. What else. Yeah what.

[08:43] (523.92s)

>> Do you do I'm not a member of

[08:46] (526.53s)

the club. And my question to you

[08:48] (528.76s)

is what's with micron. They

[08:50] (530.63s)

reported earnings. They were

[08:52] (532.53s)

outstanding. Made a new high at

[08:54] (534.67s)

137. And now it's like they're

[08:56] (536.00s)

going out of business.

[08:57] (537.30s)

>> I got to tell you I look at

[08:59] (539.54s)

it every day. You know I said

[09:00] (540.91s)

what's with micron three times

[09:02] (542.58s)

today. I think that run from

[09:04] (544.41s)

from 70 to 130 really got people

[09:07] (547.25s)

spooked I don't know. Now

[09:09] (549.01s)

everyone's talking about how the

[09:10] (550.15s)

charts bad. I'm with you. I

[09:12] (552.05s)

think the stock is inexpensive.

[09:13] (553.79s)

But you know what the chart is

[09:15] (555.42s)

saying. We got to wait. I'm

[09:16] (556.79s)

going to obey the chart. I just

[09:18] (558.62s)

am I'm going to obey the chart.

[09:20] (560.49s)

And anyway, I like Nvidia. Let's

[09:22] (562.23s)

go to Anthony in Florida

[09:23] (563.53s)

Anthony.

[09:23] (563.76s)

>> Hey Jim I just want to tell

[09:25] (565.63s)

you I'm a member since day one

[09:28] (568.20s)

and I love the meetings. I do

[09:29] (569.03s)

not miss them with you and Jeff.

[09:30] (570.67s)

They're really great.

[09:31] (571.74s)

>> Jeff works so hard Jeff he

[09:33] (573.51s)

when he goes out to lunch, he

[09:34] (574.87s)

goes out for like 30s. It's

[09:37] (577.21s)

incredible. The guy is so

[09:38] (578.18s)

intense, I love it. I sit right

[09:40] (580.41s)

next to him and he is so

[09:41] (581.68s)

dedicated to the club and it's

[09:43] (583.08s)

fantastic. He's dedicated to

[09:44] (584.52s)

you. How can I help?

[09:45] (585.78s)

>> Oh, I appreciate it. I'm, you

[09:48] (588.22s)

know, 60 years old and I still

[09:50] (590.49s)

got some time to stay in the

[09:51] (591.89s)

market. And I want to get some

[09:54] (594.16s)

dividends. And the reason is my

[09:57] (597.40s)

company that I have. What do you

[09:58] (599.00s)

think about Verizon with a 7%

[10:00] (600.63s)

dividend?

[10:00] (600.90s)

>> I think it's okay. It's

[10:02] (602.43s)

really just a bond. I mean,

[10:04] (604.20s)

there's a lot of competition now

[10:05] (605.80s)

in the telco business. You know,

[10:07] (607.67s)

I wrote this book, I wrote this

[10:09] (609.64s)

book, How to make Money in any

[10:12] (612.04s)

market. And I had to default to

[10:14] (614.15s)

a lot of the real estate

[10:15] (615.35s)

investment trusts and to a lot

[10:17] (617.08s)

of the master limited

[10:17] (617.82s)

partnerships in the oil market.

[10:19] (619.38s)

Those are the only place where I

[10:21] (621.55s)

see really great value in

[10:22] (622.86s)

dividends right now, because the

[10:23] (623.66s)

stock market has run so much.

[10:24] (624.62s)

It's a quandary, but those are

[10:26] (626.59s)

the way to be able to answer the

[10:29] (629.10s)

quandary. All right. Look, I'm

[10:30] (630.50s)

hoping President Trump cools it

[10:31] (631.66s)

with the two late Paypal

[10:32] (632.70s)

rhetoric. I find it it seems too

[10:34] (634.17s)

insulting for me at this point.

[10:35] (635.60s)

I think he's only hurting

[10:36] (636.97s)

himself. And of course, the

[10:38] (638.30s)

markets do. On Mad Money tonight

[10:39] (639.97s)

with earnings season kicking

[10:41] (641.14s)

off, as always with the

[10:42] (642.01s)

financials, I'm digging through

[10:42] (642.88s)

the top and bottom lines of all

[10:45] (645.71s)

the reports and giving you my

[10:46] (646.68s)

take on the big banks and lots

[10:48] (648.35s)

of surprising stocks have been

[10:49] (649.65s)

rallying lately, but I found one

[10:51] (651.42s)

that I think takes the cake.

[10:53] (653.15s)

I'll reveal what it is and

[10:54] (654.79s)

whether you should take a take a

[10:56] (656.09s)

cut of the cheese. And we have

[10:57] (657.82s)

the big banks reporting strong

[11:00] (660.39s)

numbers. But what about the

[11:01] (661.79s)

regionals? I'm getting the

[11:02] (662.60s)

latest with the top brass first

[11:04] (664.40s)

horizon. So stay with Cramer.

[11:14] (674.74s)

>> Don't miss a second of Mad

[11:16] (676.17s)

Money Follow JimCramer on X.

[11:18] (678.81s)

Have a question tweet Cramer

[11:20] (680.85s)

hashtag mad mentions. Send Jim

[11:23] (683.42s)

an email to madmoney.cnbc.com.

[11:26] (686.25s)

Or give us a call at one 800 743

[11:29] (689.79s)

CNBC. Miss something. Hea

YouTube Deep Summary

YouTube Deep Summary Extract content that makes a tangible impact on your life